One Legal — How do I open a One Legal account?

Setting up a One Legal account is simple and takes just a few minutes, giving you access to a full suite of services such as court filing--both electronic

Explore web search results related to this domain and discover relevant information.

Setting up a One Legal account is simple and takes just a few minutes, giving you access to a full suite of services such as court filing--both electronic

Account Legal is attorney trust accounting software like you’ve never experienced before. In just a few seconds, you can generate monthly and quarterly client reports, then download them into a secure pdf format. Our software also comes with an alert system that warns of possible ... Account Legal is attorney trust accounting software like you’ve never experienced before. In just a few seconds, you can generate monthly and quarterly client reports, then download them into a secure pdf format. Our software also comes with an alert system that warns of possible mishandling/misappropriation of funds.Server Security: Account Legal runs on Amazon cloud servers. Amazon's world-class, highly secure data centers utilize state-of-the art electronic surveillance and multi-factor access control systems. Data centers are staffed 24x7 by trained security guards, and access is authorized strictly on a least privileged basis.Client's Data Protection: Your clients’ data belongs to you and you alone. If you should ever decide that Account Legal is not right for you and you want to switch to another provider, you are able to take your clients’ data with you, making the transition as easy and seamless as possible.Rochapps is a software company that specializes in building custom legal management software. Bringing software solutions to our users is our passion. Having the right attorney trust accounting software can save you time and money, and have you properly prepared for your next audit.

Simplify legal trust account management with Clio and stay compliant with state bar regulations. Trusted by 150,000+ lawyers and approved by 100+ bars. Clearly present line items on your legal invoices that detail the movement of funds held in trust along with remaining trust balances. Use evergreen trust management to stay on top of retainers in Clio’s trust account management software to set an alert when available funds drop below a certain threshold.With several reconciliation options, choose to manage your firm’s trust accounts from the same place you already bill and collect payments—right in Clio. Simply match trust transactions to your bank account statement directly from the Accounts tab. Run built-in legal trust account reports required for trust accounting compliance.Whether it’s Clio Accounting, or our best-in-class accounting integrations with QuickBooks Online or Xero, Clio helps you efficiently manage your firm’s accounting so you can avoid data-entry errors and remain compliant, no matter how you work. ... Hear what other law firms have to say about Clio’s legal accounting software.Clio’s best-in-class integration with Xero syncs your Clio contacts, time and expense activities, bills, credit notes, interest, and Clio Payments transactions for accounting purposes. For more information, visit the help center. Stay organized, and access the information you need—from anywhere, at any time. ... Edit, store, and organize your legal documents securely, from anywhere.

Client accounting. At first, the concept seems straightforward: Client money connected to an underlying legal service—whether it’s money for unearned fees (typically paid as a retainer), conveyancing, settlement funds, or the administration of estates—is not yours, so keep it in a separate ... Client accounting. At first, the concept seems straightforward: Client money connected to an underlying legal service—whether it’s money for unearned fees (typically paid as a retainer), conveyancing, settlement funds, or the administration of estates—is not yours, so keep it in a separate account to avoid accidentally spending it.Many lawyers turn to Intuit QuickBooks or Xero for managing their accounting and recordkeeping, rather than Excel spreadsheets. QuickBooks and Xero integrate with Clio’s case management software, which helps save time on data entry. Klyant—a comprehensive, cloud-based legal accounting application for European law firms—is built specifically to make it easier to manage client accounts for legal practices.Make sure your office policies for client accounts are clear so that an assistant does not accidentally combine funds or commit some other clerical error. Set up systems to guard against error. Stay on top the essentials, like vetting staff and keeping your technology current, to keep your name off the disciplinary list. Get assistance from technology. Ditch the Excel spreadsheet or paper ledger, and use some of the many available legal accounting tools—like Klyant—to better manage your client accounts.Additionally, Clio integrates directly with popular client accounting software Xero, QuickBooks Online, and Klyant. For more about Clio’s legal accounting capabilities, see our Client Accounting Software page.

Legal accounting software that integrates with powerful time, billing, and financial reporting features to maximize efficiency and revenue. We handle a lot of criminal defense with clients on payments plans, so having integrated accounting allows us to see our updated trust account balances in real time, which is a godsend when handling those types of cases.” ... Quickly gain accurate insight into different billing cycles, and easily prepare end-of-year statements. CARET Legal offers robust financial reporting with nine different native reports:Certain tiered users with full accounting access will be able to create additional custom reports/cards, like Effective Rate and Accounts Receivables, via the advanced CARET Analytics Overview. Using purposely-designed legal accounting software gives you access to powerful capabilities missing from generic solutions.CARET Legal comes with built-in accounting software that helps align financial processes and workflows to raise intra-firm standards, protect your books, and save time.Native accounting features include legal invoice automation with pre-billing, bulk and batch billing, legal trust accounting, contingency billing, and even integrated time-keeping and payment processing.

Your law firm's accounting department helps the business stay on the right side of the law, when it comes to both internal operations and external relationships. Because legal work involves high stakes, accuracy is of the utmost importance in handling finances. Effective training and internal controls are essential to prevent fraud and manage legal finances successfully. Centerbase’s Accounting and Online Banking tools provide robust solutions for managing law firm accounting needs.A CPA can provide essential guidance on fulfilling tax obligations while minimizing tax liabilities and assist with financial tasks, including forecasting, reporting, payroll processing, and trust accounting. Calculating legal time is complex, making law firm payroll especially challenging.Invoicing is a critical component of law firm accounting, serving as the primary method for billing clients for legal services. Mistakes in invoicing can lead to unbilled tasks, irregular billing, and unpaid invoices, which can adversely impact a firm's financial health.IOLTA Account: Interest on Lawyers Trust Accounts (IOLTA) is used to manage client funds separate from the firm's finances, which is crucial for maintaining compliance with trust accounting rules. A fundamental principle in legal accounting is maintaining separate operating and trust accounts.

While general accounting solutions can help any business streamline its processes, they aren’t built to accommodate the unique accounting needs of law firms (such as trust accounting), making them challenging to use. No matter the size of your law firm, legal accounting software that is built ... While general accounting solutions can help any business streamline its processes, they aren’t built to accommodate the unique accounting needs of law firms (such as trust accounting), making them challenging to use. No matter the size of your law firm, legal accounting software that is built with lawyers in mind, not just accountants, helps make legal accounting more approachable and reduces errors–helping to keep firms compliant with their jurisdiction’s regulations and streamlining financial workflows.Ensure that amounts in trust are reconciled (between Clio, QuickBooks, and your associated bank accounts). Create accurate data reports. Using a legal-specific accounting solution like Clio and QuickBooks make it easier to set up and maintain a law firm chart of accounts in two key ways:Sync between Clio and QuickBooks. Once set up, you can sync your Clio and QuickBooks accounts—including trust accounts, trust liability accounts, and advanced client cost accounts. Learn more about legal trust accounting in QuickBooks and Clio.To make the financial information in your law firm chart of accounts useful for record-keeping and for assessing your firm’s financials, create separate general ledger income accounts to differentiate the different types of income—including referral income. These should also be split by practice area or by partners. Creating an accurate, detailed legal chart of accounts is an important tool to give you an accurate picture of where your firm’s financials stand.

A client trust account is like a safe haven for your client's funds, separate from your firm’s operating accounts. It’s where you hold money on behalf of your clients, ensuring it's used exclusively for their legal needs and expenses. You should deposit any funds received on behalf of a client that aren’t immediately earned or allocated to cover expenses. This includes settlement checks, retainers, and any other advance payments. Personal or the firm’s operating funds should never be mixed with client trust account funds. Commingling funds can lead to serious ethical and legal repercussions.An IOLTA (Interest on Lawyers Trust Accounts) account is an interest-bearing checking account that an attorney or law firm maintains for client funds nominal in amount or held for a short period of time. The interest on these accounts is then transferred to the state bar. As an aside, this interest is used to fund legal aid programs and other charitable activities.An escrow account is generally used to hold funds or assets during transactions, like real estate deals, and is managed by a neutral third party. In contrast, a client trust account is specifically for holding and managing client funds related to legal services.If it’s a pooled trust account shared with other lawyers, they may also make deposits. To withdraw funds from the trust for expenses, including paying yourself for your legal services, you have to move those funds into a separate account rather than drawing directly from the trust.

Learn how standard & legal accounting differ in these 10 ways. Why is specialized expertise essential for your law firm's financial compliance and success? Think about it: law firms handle client money in a way most businesses don’t. Fee structures are unique, and how you account for work in progress can significantly impact your bottom line. It’s a lot to keep track of! That’s why understanding these differences is crucial for the financial health of any law practice. This blog post aims to highlight the key differences between legal accounting and standard accounting.We’ll look at why law firms need specialized expertise and how it can make a difference in your firm’s success. Plus, we’ll touch on how Cashroom provides expert accounting services to address these very challenges. Perhaps the most significant difference between legal and standard accounting?Flat fees: Single payments for specific legal services. Retainer arrangements: Advanced payments held in trust. These diverse billing methods create accounting complexities not found in standard businesses. For instance, contingency fees require tracking case expenses over potentially years before you can recognize revenue.This creates financial reporting challenges that don’t exist in standard business accounting, where the connection between work performed and revenue recognition is typically more straightforward. Want to improve your firm’s cash flow management? Then download our free guide: 10 Simple Ways To Manage Your Law Firm’s Cash Flow for practical strategies tailored to legal practices.

Generally, an account is a record, history, or report of something. A witness account is a witness’s report of what they perceived.A financial account is a financial ledger that keeps a record of payments made into and out of it, often held by a financial institution on behalf of a person or organization.A client account is an established arrangement between two entities that do business together, or a business’s file of information about a prospective client it may do business with in the future.An online account is a person’s key to personal (i.e., tracked) website access, usually accessed with an account number, username, or email, in combination with a password.

Google Account Help · Sign in · Google Help · Help Center · Community · Google Account · Privacy Policy · Terms of Service · Submit feedback · Send feedback on... This help content & information · General Help Center experience · Next · Help Center · Improve your Google Account · Google Account · false · Search · Clear search · Close search · Google apps · Main menu · 18426612851605046500 · true · Search Help Center · true · true · true · true · true · 70975 ·

Rochapps is a software company that specializes in building custom legal management software. Bringing software solutions to our users is our passion. Having the right attorney trust accounting software can save you time and money, and have you properly prepared for your next audit. Verify that your bank statement and your Account Legal statements match.Account Legal is one of the many solutions that RochApps offers to legal professional – from private practices to big law firms.We tried out several of the other legal/trust accounting softwares in the marketplace, and we concluded that we could create a better, more user-friendly solution.Try it out for yourself and find out why a growing number of legal professionals are switching to Account Legal.

You must be age thirteen (13) (or equivalent minimum age in your Home Country, as set forth in the Apple Account creation process) to create an account and use our Services. Apple Accounts for persons under this age can be created by a parent or legal guardian using Family Sharing or by an ... You must be age thirteen (13) (or equivalent minimum age in your Home Country, as set forth in the Apple Account creation process) to create an account and use our Services. Apple Accounts for persons under this age can be created by a parent or legal guardian using Family Sharing or by an approved educational institution, though certain devices may prevent such Apple Accounts from accessing certain Services on the device.A parent or legal guardian who is creating an account for a minor should review this Agreement with the minor to ensure that they both understand it.- All other Services (including but not limited to iTunes Store, Apple Music, and Apple Podcasts): https://www.apple.com/legal/internet-services/itunes/itunesstorenotices · This is the fastest way for us to process your notification of claimed infringement. The slower method to reach our designated agent and to process your notification is to send a proper and complete notification of claimed infringement to the mailing address listed below. ... Apple has adopted a policy to disable and/or terminate in appropriate circumstances the accounts of users who are found repeatedly to infringe or are repeatedly claimed to infringe the copyrights of others.This Agreement governs your use of Apple’s services (“Services” – e.g., and where available, App Store, Apple Arcade, Apple Books, Apple Fitness+, Apple Music, Apple News, Apple News+, Apple One, Apple Podcasts, Apple Podcasts Subscriptions, Apple Sports, Apple TV, Apple TV+, Apple TV Channels, Game Center, iTunes, and Shazam), through which you can buy, get, license, rent or subscribe to content, Apps (as defined below), and other in-app services (collectively, “Content”). Content may be offered through the Services by Apple or a third party. Our Services are available for your use in your country or territory of residence (“Home Country”). By creating an account for use of the Services in a particular country or territory you are specifying it as your Home Country.

Firms may only use a client’s money for their legal matters. In other words, lawyers must keep a watchful eye on how much each client has in trust, as they can’t use one client’s money to cover expenses for another client. Conceptually, it’s simple. Keep money that isn’t yours in a separate account ... Firms may only use a client’s money for their legal matters. In other words, lawyers must keep a watchful eye on how much each client has in trust, as they can’t use one client’s money to cover expenses for another client. Conceptually, it’s simple. Keep money that isn’t yours in a separate account so that you don’t accidentally spend it.IOLTA stands for Interest on Lawyers' Trust Accounts. This program manages client funds held in trust by lawyers, which are typically nominal in amount or deposited for a short period only. Any interest earned on these funds is pooled together and used for legal aid, increasing access to justice for those who are unable to afford it.Forgetting to keep accurate records. Accurate and detailed records are an important part of trust accounting for lawyers. This includes records of all transactions, including deposits, withdrawals, and transfers. Legal software can be a powerful tool in streamlining this process.If you are using trust accounting at your firm, you can follow the process below: A client or third party, like an insurance company, hands your office a check for money that isn’t yours—such as unearned legal fees or settlement money.

Learn how accounting law governs financial practices, court-ordered audits, GAAP, and law firm compliance. Essential for litigation, audits, and ethics. The accounting law definition is the system used to record, summarize, analyze, and categorize the financial transactions of an individual or a business. This is used in legal cases to determine the amount of damages owed to a plaintiff.If the court requires accounting in a lawsuit, the defendant must account for his or her administration of the affairs in question. This may include: The management of an estate by an executor. The disclosure of the business actions of a partner. This legal remedy dates back to ancient courts of equity, in which the officers of the chancery served as auditors on behalf of the king.Public Company Accounting Oversight Board (PCAOB): Oversees audits of public companies to protect investors. Securities and Exchange Commission (SEC): Enforces regulations related to financial disclosure and investor protection. State Bar Associations: Set guidelines for legal accounting, including client fund management and ethical billing practices.Compliance with these regulatory bodies ensures transparency, reduces fraud, and fosters public confidence in the financial and legal systems. The existence of these rules, guidelines, and procedures creates public faith in the system by those who participate in the economic marketplace. The aftermath of the 1929's stock market crash showed the disastrous financial consequences of a lack of public faith. Organizations including the SEC, the FASB, and the American Institute of Certified Public Accountants (AICPA) have developed modern accounting principles.

The basics of law firm accounting and attorney bookkeeping ... Best practices to follow. We’ll also show you how legal accounting software can make the whole process easier (and more effective). Ready to dive in? Before we go any further, it’s important to distinguish between two terms that can sometimes be used interchangeably, but shouldn’t be: bookkeeping and accounting. Legal bookkeepers and legal accountants work with your firm’s financials, with the shared goal of helping your firm financially grow and succeed.Bookkeepers record the financial transactions and balance the financial accounts for your firm. Legal bookkeeping takes place before any accounting can occur and is an important administrative task for any law firm.The chart of accounts for law firms should include the IOLTA or trust account, as well as a trust liability account (to offset and show that the funds in the IOLTA account are not the law firm’s). Client Trust Ledger: A statement of activity that shows all of the transactions (beginning balance, deposits in, payments out, and ending balance) for each client. Learn more about the legal chart of accounts and view examples of formatting.While the specifics vary from state to state (it’s important to check the details for your jurisdiction), an IOLTA account is a type of bank account from which any interest earned on the account is collected and forwarded to the state bar (usually to funds for social justice or legal aid).

WASHINGTON: The White House launched a TikTok account on Tuesday (Aug 19), as President Donald Trump continues to permit the Chinese-owned platform to operate in the United States despite a law requiring its sale. "America we are BACK! What's up TikTok?" read a caption on the account's first ... WASHINGTON: The White House launched a TikTok account on Tuesday (Aug 19), as President Donald Trump continues to permit the Chinese-owned platform to operate in the United States despite a law requiring its sale. "America we are BACK! What's up TikTok?" read a caption on the account's first post on tThe account had about 4,500 followers an hour after posting the video.Trump's personal account on TikTok meanwhile, has 110.1 million followers, though his last post was on Nov 5, 2024 – Election Day.Trump's official account on X, formerly Twitter, has 108.5 million followers though his favored social media outlet is Truth Social, which he owns, where he has 10.6 million followers.

The Council for Licensed Conveyancers has issued its first approval for a law firm to use a third-party managed account for its client funds. The Council for Licensed Conveyancers (CLC) has issued its first approval for a law firm to use a third-party managed account (TPMA) for its client funds. Digital property exchange PEXA, which owns Bolton-based Amity Law and will be its TPMA provider, told Legal Futures that it also plans to provide a TPMA for Optima Legal, regulated by the Solicitors Regulation Authority.The spokeswoman said: “We have already integrated the PEXA technology into Optima and this is the logical next step, to deliver PEXA-enabled remortgage transactions through Optima Legal.” · Law firms regulated by the SRA do not need the regulator’s approval to use a TPMA, but they are required to inform it that they are using one – the SRA is eyeing TPMAs as an eventual replacement for client accounts, while last month the government said they could in time reduce the risk of law firms’ client accounts being used by criminals for money laundering.PEXA processes around 90% of conveyancing completions in Australia. It launched in the UK in early 2022, buying Optima Legal in September that year.Sarah Ryan, head of legal practice and finance and administration at Amity, said: “Having PEXA on board as a TPMA is a game changer.

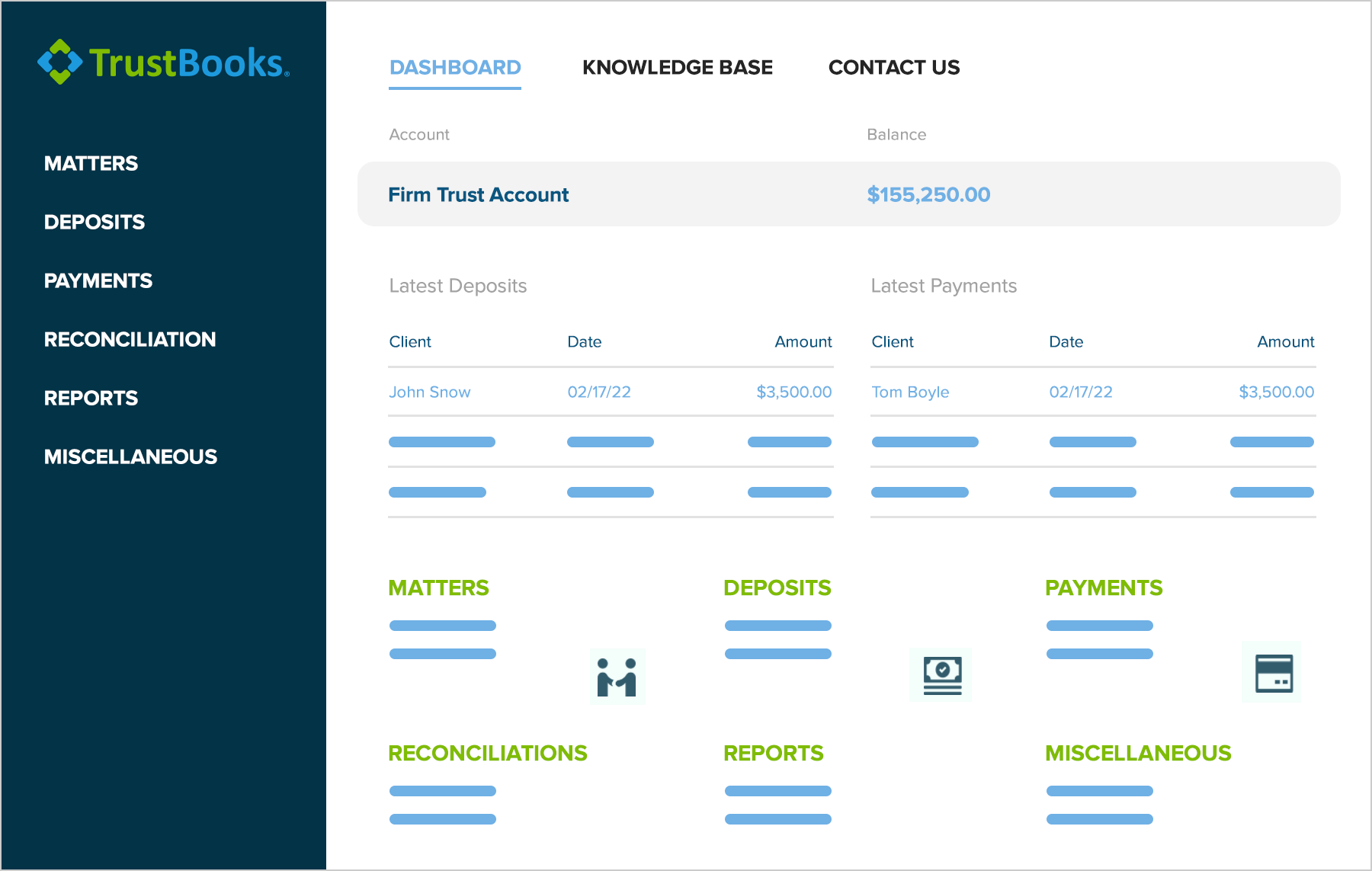

*Up to 100 transactions per month. Over 100 transactions? Contact our team. Needing more hands-on accounting support? We have a team of legal accounting experts ready to help you with your data entry, onboarding, and reconciliation projects. Finally, a software solution for small law firms that takes into account all of the trust accounting requirements of the State Bar and helps make sure you comply with them. Start a free 14-day trial today and see how easy 3-way reconciliations, generating reports and more can be with your trust accounts.TrustBooks has simplified the intricacies of trust accounting such that I can focus more on my client’s needs and less on law firm administration. The software is extremely user-friendly and accessible, and support is just an email or phone call away.Trustbooks has completely changed my view on trust accounting for my firm. It takes into account all of the trust accounting requirements of the State Bar and helps make sure you comply with them.Trustbooks has simplified the trust accounting for my firm and I no longer dread doing reconciliations or an audit from the State Bar.

Only in-house counsel jobs. From corporate counsel to general counsel jobs, GoInhouse.com is a great place to find and post inhouse counsel jobs. Check daily for new jobs.